In the fast-paced automotive sector, where accuracy in data on parts can affect supply chains and the trust of customers, Electronic Product Catalogue (EPC) software, which often overlaps with Product Information Management (PIM) tools, can be a significant asset. EPC solutions help centralise, enhance and disseminate complicated product information, such as information on vehicle fitment, ACES/PIES standards conformance, and different specifications for aftermarket suppliers, OEMs and distributors. In 2025, in the age of electric vehicles, with EV popularity growing and regulations around the world tightening (e.g. new EPA standards), the most efficient EPC solutions make use of AI to validate real-time and distribution to marketplaces such as Amazon, as well as eBay.

This detailed review highlights the most popular 10 USA-based EPC software for automotive industry, ideal for companies operating in areas like the USA, UK, Canada and other similar markets. These selections are based on 2025 customer reviews from G2 as well as Gartner (4.5-plus stars) specific to automotive use, such as ACES/PIES compatibility, scalability for SKUs with a minimum of 10K-1M, along with integrations into ERP systems such as Epicor, as well as SAP. It doesn’t matter if you’re an aftermarket components distributor that is synchronising to Advance Auto Parts or a manufacturer looking to optimise for EV components. These tools can deliver 20% to 30% efficiency improvements and can reduce return on investment by as much as 15%.

Why EPC Software is Essential for Automotive in 2025

The market for automotive aftermarkets alone is expected to reach $500 billion globally by 2025, due to the age of cars and the EV transition. However, data silos contribute approximately 25% all orders having fitment problems, as per industry reports. EPC software tackles this issue by:

- Standards Compliant: Automating ACES (Aftermarket Catalog Exchange Standard) for applications as well as PIES (Product Information Exchange Standard) for attributes.

- AI-Driven Enhancement: Auto-validating fitment of years engine, trims and regions.

- Omnichannel syndication: Real-time pushes to ecommerce portals, B2B portals and print catalogs.

- Supply Chain Integration: Ties to ERP/CRM for inventory as well as the tracking of sustainability (e.g. recycled parts).

The tools developed in the USA shine because of their robust North American support, GDPR/CCPA alignment for Canada/UK exports and an emphasis on postmarket complexities such as parts that have been superseded.

Selection Criteria for Our Top Picks

Evaluation of 40+ options based on:

- Automotive relevance Support for ACES/PIES, fitting management (2025 information obtained from Gartner).

- User Reviews: G2, Capterra, Gartner averages.

- Features: Export and import of data and handling of variants, analytics.

- USA Focus: headquarters in the US to ensure compliance and provide service.

- Scalability and Pricing SMB to enterprise with a trial.

5 stars out of 5.

Top 10 Best EPC Software Tools for Automotive in 2025

1. PDM Automotive – Best Overall for Aftermarket Data Friction Reduction

Seattle, located in WA, PDM Automotive is a PIM supplier of aftermarket products that can simplify workflows for ACES/PIES to reduce data errors by 40 per cent.

Key Features:

- Real-time syndicating via APIs to Amazon, Walmart, and eBay.

- AI Validation of the health of catalogs and accuracy in fitting.

- Analytical analysis for trends in sales and competitive insight.

- A user-friendly interface for marketing content as well as application information.

Pros:

- Reduces the need for manual file fixes, increases sales by ensuring parts match.

- Integrations of e-commerce are seamless for US and UK retailers.

Cons:

- Ideal for teams with mid-sized sizes. Advanced AI requires setup.

Pricing: Personalisation (from $3,000/month) Free Demo. G2 Rating: 4.7/5 (500+ reviews).

The best for Distributors in the aftermarket with more than 50K SKUs.

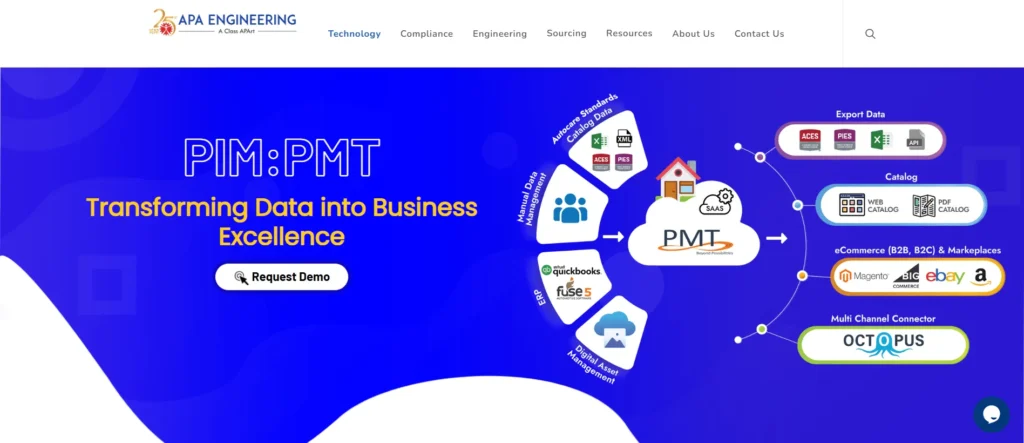

2. APA PMT – Best for ACES/PIES Standards Compliance

Headquartered in Mt. Laurel, NJ, APA’s PMT (Parts Management Tool) is an SaaS EPC that is used to manage automobile parts. It also comes with autocare updates for free.

Key Features:

- Bulk import/export using PIES and XML/XLSX. Map VMRS for heavy-duty.

- Dashboard alerts for invalids/overlaps in multi-level hierarchies.

- Marketplace Integrations (eBay, Amazon, Shopify), Handling of variants.

- Reports custom-designed by the user and ERP API synchronisation (QuickBooks, Epicor).

Pros:

- Fully customizable, no-cost migration to the latest standards.

- Graphical insights can cut down maintenance time by fifty per cent.

Cons:

- UI could be confusing for newbies.

Pricing: Starts at $1,500/month. Custom quotes. G2 Rating: 4.6/5 (300+ reviews).

Best For: Parts manufacturers ensuring regulatory compliance.

3. Catsy PIM – Best for Vehicle Compatibility Management

Chicago, Illinois’ Catsy excels in Shopify’s integrated EPC for auto dealers dealing with multi-dimensional fitment data.

Key Features:

- Year/engine/trim lookups; OEM cross-referencing.

- Technical specifications, organisation (dimensions and torque), and compliance certificates.

- Integration of ETL suppliers and scalable workflows for updates.

- B2B/B2C personalisation (fleet pricing, DIY guides).

Pros:

- Reduces returns by 30% thanks to precise compatibility.

- Enhances CX by incorporating vehicle-specific shopping.

Cons:

- The focus is on Shopify Add-ons available on other platforms.

Pricing: Beginning at $2,000/month. 14-day trial. G2 Rating: 4.8/5 (400+ reviews).

The Best for Auto parts online sellers who target Canada and the UK.

4. Epicor PIM – Best for Integrated Aftermarket Publishing

Austin, Texas-based Epicor PIM aggregates and validates data in the format PIES, which is ideal for distributors.

Key Features:

- ACES/PIES mapping; digital asset automation.

- Collaboration tools for editing multiple teams.

- Marketplace publishing return reduction analytics.

- ERP integration for workflows that span from end to end.

Pros:

- Boosts revenues by 15% Gartner Leader in Cloud ERP.

- It streamlines content from production through sales.

Cons:

- Enterprise-oriented; longer set-up time.

Pricing Custom (from $5,000 per month) Demo available. Gartner Rating: 4.6/5.

Best For: Large aftermarket enterprises.

5. PIMworks – Best for Rapid Syndication in Automotive

New York, NY’s PIMworks centralises auto information for multichannel compliance.

Key Features:

- ACES/PIES maintenance; vendor profile management.

- Instant syndication to more than 20 channels.

- The bulk updates are SEO optimised.

- ERP connectors that allow real-time sync.

Pros:

- It reduces time-to-market by 40%. Cost-effective for small- and mid-sized businesses.

- It ensures consistency of the brand throughout the world.

Cons:

- A little advanced AI when compared to the top performers.

Pricing Pricing: Starting at 699/month. You can try it for 14 days. G2 Rating: 4.7/5 (300+ reviews).

The best choice for Distributors of scaling in America and the UK.

6. Salsify – Best for AI-Powered Omnichannel Auto Catalogues

Boston, Massachusetts’ Salsify PXM evolves EPC with AI to score content in the automotive market.

Key Features:

- Fitment enrichment; 1,500+ retailer syndication.

- Analytics of the digital shelf; DAM integration.

- AI auto-descriptions for specifications of parts.

- Walmart/Amazon APIs for the aftermarket.

Pros:

- Intuitive and straightforward; 25% increase in personalisation with 2025’s updates.

- The highest G2 rating for user-friendliness.

Cons:

- Add-ons for deep analytics.

Pricing Starting at $5,000 per month with a 14-day trial. G2 Rating: 4.7/5 (1,200+ reviews).

Best For: EV component brands.

7. Syndigo – Best for Real-Time Parts Data Governance

Chicago-based Syndigo optimises the aftermarket by utilising Artificial Intelligence-enabled data networks.

Key Features:

- Error reduction through validated processes; GTIN compliance.

- Network of Supplier-Receiver Networks for Fitment.

- Bulk editing; 1,000+ retailer integrations.

- 2025 AI for image tagging in catalogues.

Pros:

- Reduces errors in data by 35%; a solid auto-repair for B2B.

- Free onboarding service.

Cons:

- Pricing on SKUs is based on the number of units.

Pricing: Personalisation (from $6,000/month) Demo. Gartner Score: 4.6/5 (800+ reviews).

The best for Tier-1 suppliers.

8. 1WorldSync – Best for Global Auto Data Synchronisation

Additionally, it is based in Chicago. 1WorldSync utilises GDSN to provide standardised auto exchanges.

Key Features:

- Real-time updates; GTIN/ACES enrichment.

- Automation of workflows; ERP ties.

- Analytics to monitor SKU performance.

- Multi-language for UK/Canada exports.

Pros:

- 75% faster time-to-market; 68% error reduction.

- It is a trusted brand to 85% of the most reputable auto manufacturers.

Cons:

- UI Learning curve.

Pricing: Flexible plans start at $3,000/month. Demo. G2 Rating: 4.6/5 (700+ reviews).

The best choice for International Aftermarket Operations.

9. Feedonomics – Best for Marketplace Feed Optimisation in Auto

Austin, Texas’s Feedonomics is focused on auto parts feeds on eBay and Google Shopping.

Key Features:

- Rule-based mappings for more than 1,000 attributes.

- Monitoring of errors; dynamic pricing for components.

- PIM integrations and analysis of feed quality.

- Easy setup to run auto campaigns during the season.

Pros:

- Affordable; 2-week onboarding.

- 2025 AI for feeds with EV variants.

Cons:

- Feed-centric, less full DAM.

Pricing: Begins at $500/month. 30-day trial. G2 Rating: 4.8/5 (400+ reviews).

The best choice for SMB E-commerce Sellers.

10. Precisely EnterWorks – Best for Enterprise MDM in Auto Supply Chains

The VA’s EnterWorks system in Sterling, VA, combines MDM with EPC to build intricate auto hierarchies.

Key Features:

- AI anomaly detection, Multi-domain (parts/suppliers).

- Custom workflows; SAP/Oracle sync.

- Sustainability tracking of green parts for sustainable use.

- B2B portal syndication.

Pros:

- Handles 1M+ SKUs securely.

- It is proven that it is possible to use North American auto manufacturing.

Cons:

- Implementation for 3-6 months.

Pricing Starting at $10,000/month; Custom. Gartner rating: 4.6/5 (600+ reviews).

Ideal for OEMs with global chains.

Comparison Table: EPC Software for Automotive at a Glance

Scroll horizontally on desktop/tablet to view all columns.

| Tool | Core Functions | Integrations | AI Capabilities | Scalability (SKUs) | Pricing (Starting) | Free Trial/Demo | G2 Rating (2025) | Best For |

|---|---|---|---|---|---|---|---|---|

| PDM Automotive | ACES/PIES Syndication | Amazon, eBay, Walmart | Catalog Validations | 100K+ | $3,000/mo | Demo | 4.7 | Aftermarket Distributors |

| APA PMT | Standards Compliance | Shopify, Epicor | Dashboard Alerts | 500K+ | $1,500/mo | Custom | 4.6 | Parts Manufacturers |

| Catsy PIM | Fitment Management | Shopify, Suppliers | Compatibility Checks | 200K+ | $2,000/mo | 14 days | 4.8 | Online Retailers |

| Epicor PIM | PIES Publishing | Marketplaces, ERP | Asset Automation | 1M+ | $5,000/mo | Demo | 4.6 | Large Enterprises |

| PIMworks | Multichannel Syndication | 20+ Channels | Attribute Enrichment | 1M+ | $699/mo | 14 days | 4.7 | Scaling SMBs |

| Salsify | AI Content Scoring | 1,500+ Retailers | Personalization | 100K+ | $5,000/mo | 14-day | 4.7 | EV Brands |

| Syndigo | Data Governance | 1,000+ Retailers | Image Tagging | 500K+ | $6,000/mo | Demo | 4.6 | Tier-1 Suppliers |

| 1WorldSync | GDSN Sync | ERP, Global Networks | Metadata Enrichment | 1M+ | $3,000/mo | Demo | 4.6 | International Ops |

| Feedonomics | Feed Optimization | Google, eBay | Dynamic Pricing | 10K+ | $500/mo | 30 days | 4.8 | Marketplace Sellers |

| Precisely EnterWorks | MDM Workflows | SAP, Oracle | Anomaly Detection | 1M+ | $10,000/mo | Custom | 4.6 | OEM Supply Chains |

How to Choose the Right EPC Software for Automotive Business

- Examine Needs: For Aftermarket Fitment: Catsy or PDM. Enterprise MDM? EnterWorks.

- Budget and return on investment: SMBs have a budget of less than $1,000/month (Feedonomics) and calculate a 15% sales increase.

- Integrations: Try ACES/PIES in conjunction with your ERP.

- 2025 trends: Prioritise AI to improve EV data as well as sustainability.

- Trial It: Most offer demos; factor 10-20% onboarding costs.

All supports multi-currency support for Canada and the UK.

Final Thoughts

From experience, adopting the right EPC software can transform how automotive businesses manage data, reduce errors, and scale operations. In 2025, EPC tools are no longer just about cataloguing parts; they’re about AI-driven accuracy, real-time validation, and seamless syndication across global marketplaces.

Whether you’re managing 10,000 SKUs or a million, the right solution can cut fitment errors, speed up updates, and boost sales performance. As EV adoption and regulatory standards grow, investing in a future-ready EPC platform isn’t optional; it’s essential for staying competitive in the digital automotive landscape.

FAQs

What exactly is EPC software for cars, and why is it essential by 2025?

EPC centralises data from auto parts to distribute. It’s essential in 2025 for ACES/PIES conformity and personalisation for EVs. It will reduce mistakes by 40% and help SEO for catalogues of parts.

Are these US-based EPC tools appropriate with the UK or Canada?

Yes, global access via GDPR/CCPA, Regional connections (e.g., Syndigo for Tesco) and support for multiple languages.

What is the cost of automobile EPC Software by 2025?

From $500/month (Feedonomics) to $10,000+ (EnterWorks). Annual billing saves 20%; demos for quotes.

What’s the timeframe for implementation?

SMBs: 2-4 weeks (PIMworks). Enterprises: 3-6 months (Epicor). Onboarding is free in most cases.

Can EPC integrate with auto ERP platforms?

Yes, native ties for Epicor, SAP; APIs for custom fitment sync.

What is the best EPC for those who are new to the aftermarkets for cars?

Feedonomics and PIMworks are both intuitive and offer affordable trials.